In 2024, the electric vehicle (EV) industry is expected to reach a turning point, ushering in a series of innovations and transformations

With the advent of 2024, the electric vehicle (EV) industry stands at a new historical juncture. The dawn of the new year signifies not only a fresh stage of technological innovation and market expansion but also heralds a series of challenges and opportunities that the sector is poised to encounter. From a potential slowdown in global sales growth to the acceleration of technological breakthroughs, and from the reshaping of competitive landscapes to adjustments in policy environments, these factors collectively paint a complex and evolving picture of the EV market landscape. Throughout this year, we will witness how the EV industry worldwide engages in self-adjustment and innovation to respond to the ever-growing market demands and the constantly shifting economic milieu.

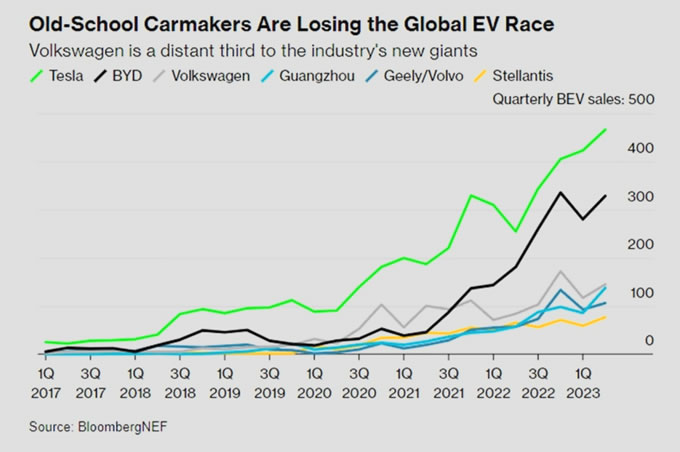

Pure electric vehicle manufacturers will continue to dominate the market as traditional automakers such as Volkswagen, Toyota, Stellantis, Mercedes-Benz, and Ford, among others, introduce electric models to stay competitive amidst the growing share of the electric vehicle market. However, compared to dedicated electric vehicle producers like Tesla, BYD, NIO, and XPeng Motors, these legacy manufacturers exhibit less agility and flexibility.Electric vehicle makers are able to move faster and leverage their first-mover advantage in technological innovation. Traditional automakers face cost pressures during their transition to electric vehicles and are grappling with strike threats from union workers in the United States, partly driven by concerns over the potential impact of electric vehicle production processes on automotive jobs.

Chinese manufacturers accelerate international expansion

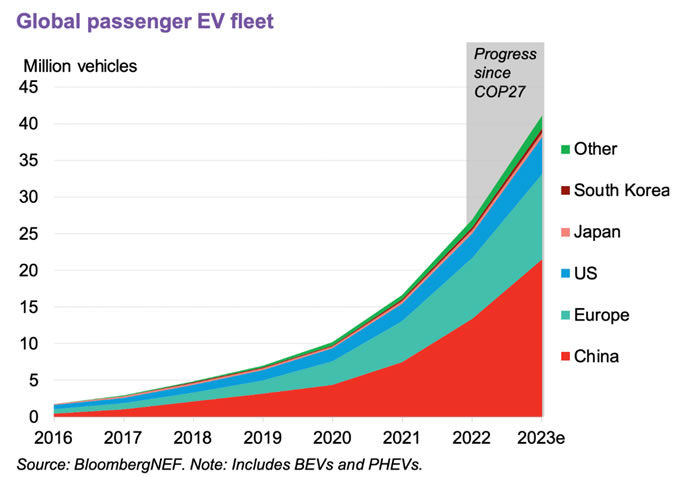

Buoyed by their success in the domestic market, Chinese automakers are now looking to hedge against potential economic slowdown by expanding overseas production and sales. China ranks fifth globally in terms of electric vehicle (EV) penetration, trailing behind Norway (80%), Iceland (41%), Sweden (32%), and the Netherlands (24%), according to data from the World Resources Institute. Yet, given its position as the world's largest automobile market, China significantly outpaces others in absolute sales volume. In 2022, China's EV market share reached 22%, amounting to 4.4 million units sold, surpassing the combined total of 3 million EV sales across other regions worldwide.

According to forecasts from Chinese auto parts supplier SuperAlloy Industrial, global sales of electric vehicles, hybrid vehicles, and fuel cell vehicles are anticipated to grow by 32% in 2024, reaching a cumulative total of 17 million units.

Although lagging in internal combustion engine vehicle production compared to other nations, Chinese automakers spotted strategic investment opportunities early on in the EV segment, aiming to export batteries and vehicles to international markets. The government also supports the adoption of EVs as a means to reduce air pollution and decrease reliance on oil imports.

As of November 2023, the market share of EVs in China's passenger car market stood at 40.4%, with retail EV sales experiencing nearly 40% year-on-year growth, reaching 841,000 units. Cumulative annual retail sales amounted to 6.81 million units, representing a 35.2% year-on-year increase. The resilience of the EV sector amidst broader economic slowdown in China underscores its structural growth. Nevertheless, Chinese automakers are gearing up to enter international markets in 2024.

Chinese automakers enter European market

Under China's "Made in China 2025" industrial strategy, the government has set a target requiring that by 2025, the country's two largest electric vehicle (EV) manufacturers derive 10% of their sales from overseas markets.

One of these companies, BYD, is actively pursuing entry into foreign markets relying on exports and localized production. "Our pace of global expansion will accelerate," the company stated in recent documents submitted to the Shenzhen Stock Exchange. BYD began delivering the European version of its sedan in November and plans to launch a mid-size SUV in Europe in 2024. Xpeng Motors, another one of the mentioned companies, sells vehicles in four European markets and plans to enter the German market in 2024. Leapmotor, too, has plans to expand into Europe by 2024.

Dutch automaker Stellantis has acquired a 20% stake in Leapmotor and intends to establish a joint venture to assist the Chinese EV start-up in extending its reach into Europe. The deal includes an option for vehicle production in Europe, reflecting Chinese automakers' intentions to begin local production to avoid import tariffs and transportation costs.

This move by Chinese automakers not only demonstrates their ambitions in the global EV market but also reflects China's rapid advancements in EV technology and manufacturing capabilities. The international expansion strategies of these companies may pose significant challenges to domestic European and other international automakers, potentially altering the competitive landscape of the global electric vehicle market.

Battery swapping technology alleviates charging dilemmas

One of the primary barriers to wider adoption of electric vehicles (EVs) is the lagging development of public battery charging infrastructure. While numerous automakers are working on establishing expansive charging networks to cater to urban areas, highways, and rural regions, the concept of battery swap stations has emerged as a way to bridge the gap until infrastructure is fully in place. Battery swapping technology enables drivers to remove depleted battery modules from their vehicles and replace them with fully-charged packs within minutes, eliminating the need for lengthy wait times during the charging process.

Chinese automaker Nio introduced its battery swapping service in 2020 and has since installed over 2,000 swap stations across China, along with 30 in Europe. The company inked agreements with Changan Automobile and Geely Auto in November to jointly develop standards for swappable batteries and to broaden and share battery swapping networks in Chinese cities.

BMW and Mercedes-Benz recently established a joint venture in China, planning to deploy at least 1,000 sites within their Chinese ultra-fast charging network, with the first stations scheduled to commence operations by 2024.

In Europe, Nio postponed its UK entry plan from 2024 to 2025 to ensure adequate battery swapping capacity. Concurrently, Stellantis has partnered with US-based Ample, utilizing its modular battery swapping technology in Stellantis' electric vehicles. The initial scheme is set to kick off in Madrid, Spain, in 2024, using 100 Fiat 500e models within Stellantis' Free2move car-sharing service.

Ample's CEO Khaled Hassounah remarked in the announcement, "Offering compelling EVs that can be fully charged in under five minutes will help to dismantle the remaining barriers to EV adoption."

Additionally, 2024 will see the expansion of bidirectional battery charging technology, adding to the ways EV owners can utilize their vehicles. This advancement will allow for greater versatility and could further stimulate the uptake of electric vehicles.

The government will recalibrate the focus of its electric vehicle incentive policies

Given that electric vehicles (EVs) typically carry a higher manufacturing cost compared to internal combustion engine vehicles (ICEs), governments worldwide have been supporting their initial adoption domestically by offering incentives such as rebates, loans, or tax credits to consumers and some manufacturers.

With the rapid growth in EV sales over the past few years, several governments are adjusting the focus of their incentive strategies. The U.S. government, through the Inflation Reduction Act, is directing automakers to establish domestic EV supply chains, stipulating that starting from January 1st, 2024, vehicles containing battery components sourced from "entities of concern," such as China, will no longer be eligible for a federal tax credit worth $7,500.

In Australia, both Victoria and New South Wales governments will cease new EV purchase incentives from January onwards, citing reduced prices by suppliers. However, they intend to reallocate some funds to install more charging stations to continue fostering adoption.

The Thai government has extended consumer EV subsidies originally due to expire at the end of this year until 2027, albeit with a reduction in their value, in response to the country's rapidly growing EV adoption rate. The robust growth in the domestic EV market coupled with manufacturer subsidies has attracted foreign investment, positioning Thailand, as Southeast Asia's automotive hub, to become a regional EV production base. An increasing number of Japanese and Chinese vehicle manufacturers have announced plans to expand their operations in the country.

Despite EVs emitting lower carbon emissions over their lifetime compared to ICEs, concerns persist about their environmental impact during the manufacturing process and the long-distance transport of finished vehicles. To address this issue, the French government aims to introduce new cash incentives for EV buyers from January 2024, which will take into account the raw materials, production methods, and components of the vehicles. This implies that Chinese vehicles manufactured in coal-powered facilities will not qualify, whereas those produced in France and the EU using renewable energy sources will be eligible.